HB 391 - The Montana Earned Income Credit: Helping Montana’s Working Families and Economy

MBPC Staff | March 2017 | Presented by the Montana Budget & Policy Center

- The Montana Working Families Credit would incentivize work and provides assistance (usually for 1-2 years) to working low-income families. This targeted policy is the most effective anti-poverty program in history, lifting millions of children out of poverty [1]

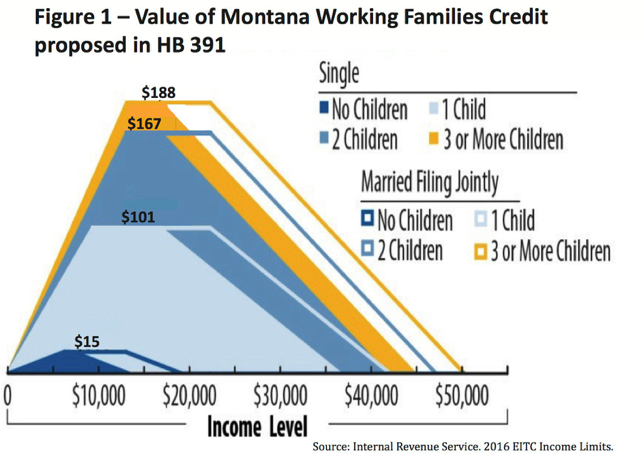

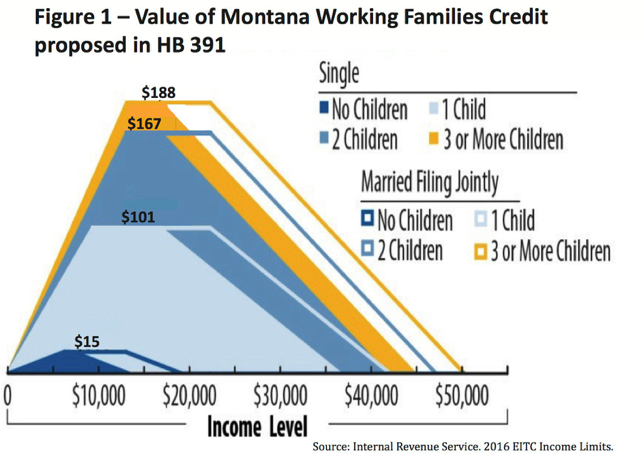

- The phased-in EITC encourages work and helps families make ends meet. A state Working Families Credit set at 3% of the federal EITC offers a maximum benefit of $188 (Figure 1).[2]With a federal credit, this is the equivalent to a wage increase of $2.75/hour for a single mother with two

- The federal EITC is often a temporary safety net. The majority of recipients receive the credit for 1-2 years to cover short-term costs like bills, groceries, and school supplies.[3]

- Montana families with two children and two parents living in poverty have the third highest tax liability of any state in the Single parent families of two children have the fourth highest tax liability.[4]A Montana Working Families Credit would mitigate the impact on families by reducing their income tax liabilities.

- Rural residents claim EITC benefits at a greater rate than urban residents. These additional funds go directly into the local economy to help support rural communities, families, and small In 2013, 21% of rural Montanans claimed a federal credit, compared to 18% of the entire population.[5]

- EITC benefits stimulate the The federal EITC injected $175 million into Montana’s economy in 2012.[6]A State Working Families Credit would provide additional support to families, who are spending those dollars in their local communities.

- Administrative costs are far lower than social safety net programs. Administrative costs are less than 1% of the benefits [7]

Number of Taxpayers Claiming EITC by County (FY 2013)

| Beaverhead |

671 |

Madison |

489 |

| Big Horn |

1,756 |

Meagher |

161 |

| Blaine |

745 |

Mineral |

363 |

| Broadwater |

372 |

Missoula |

9,159 |

| Carbon |

673 |

Musselshell |

334 |

| Carter |

68 |

Park |

1,257 |

| Cascade |

7,277 |

Petroleum |

44 |

| Chouteau |

324 |

Phillips |

333 |

| Custer |

898 |

Pondera |

519 |

| Daniels |

93 |

Powder River |

83 |

| Dawson |

529 |

Powell |

492 |

| Deer Lodge |

713 |

Prairie |

73 |

| Fallon |

137 |

Ravalli |

3,230 |

| Fergus |

873 |

Richland |

605 |

| Flathead |

7,830 |

Roosevelt |

1,271 |

| Gallatin |

5,915 |

Rosebud |

895 |

| Garfield |

69 |

Sanders |

918 |

| Glacier |

1,829 |

Sheridan |

191 |

| Golden Valley |

54 |

Silver Bow |

3,047 |

| Granite |

198 |

Stillwater |

429 |

| Hill |

1,605 |

Sweet Grass |

216 |

| Jefferson |

611 |

Teton |

353 |

| Judith Basin |

108 |

Toole |

312 |

| Lake |

2,883 |

Treasure |

45 |

| Lewis and Clark |

4,696 |

Valley |

565 |

| Liberty |

90 |

Wheatland |

136 |

| Lincoln |

1,533 |

Wibaux |

61 |

| McCone |

121 |

Yellowstone |

11,141 |

Source: Brookings Institution. Earned Income Tax Credit Interactive and Resources