In Montana, we share responsibility for each other, and the strength of our children and communities depends on the vibrancy and cohesiveness of our diverse population. Montana kids and families do best when community health services are funded, students and teachers have what they need to provide a modern education for every child, and historical and current day policies that create barriers for American Indian children and families are eliminated. Where our kids start out should not determine where they end up.

Unfortunately, Montana ranks 26th in the nation for overall child well-being. We even rank lower than our neighboring states Idaho, North Dakota, and South Dakota.[1] For too long, Montana policymakers continue to allow tax cuts for special interests that have starved our state budget from the revenue we need to prioritize crucial programs for Montana kids. As a result, many children are walking into schools with failing heating systems, out-of-date technology, and teachers who are stretched too thin leaving students without the full support they need to succeed. Many of these children are in families struggling to cover the basic necessities, like nutritious food, stable housing, and quality early childhood care.

It is not too late for Montana to chart a new course to improve child well-being. This work starts with sound tax policies that ensure a fair tax system that generates sufficient revenue to support programs and services to improve the lives of children. Specifically, Montana policymakers should:

Revenue Unleashes Kids’ Potential

Montana is falling behind other states, resulting in a lower quality of childhood health. Montana ranks 44th in the nation for childhood health.[2] When our children struggle, it is the sign of a deeper problem.

It means our families, communities, and economy are struggling. Policies like public pre-kindergarten (pre-K), investments in public school infrastructure, and childhood health can improve health and well-being for Montana’s children. These investments pay off enormously over time.

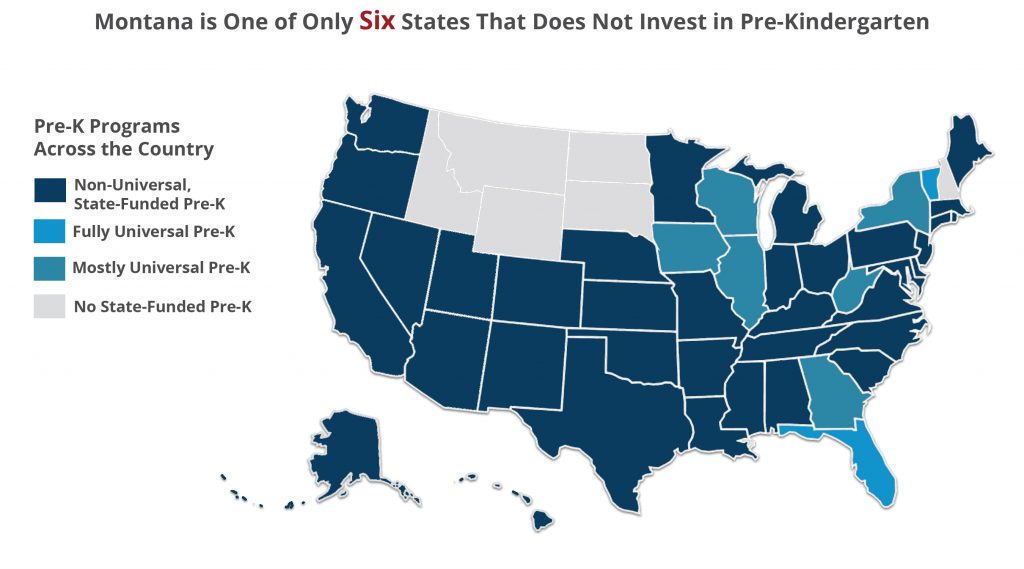

One of the most important investments we can make to ensure our children’s success in kindergarten and beyond is early childhood education. Yet, Montana is one of only six states that have not funded statewide public pre-K, providing four-year-old children with access to quality early childhood education. High-quality preschool helps prepare children to enter school with stronger cognitive and emotional skills and promotes better economic and health outcomes over a lifetime.[3] Investing in quality early childhood education is good for the state too, as it produces a 13 percent return on investment through greater academic achievement, higher graduation rates, reduced crime, and increased lifetime earnings.[4] Quality early education also improves health outcomes for children through nutrition programs, increased health and dental screenings, and improved child and parent mental health.[5] Montana should follow the lead of almost all other states and invest in the education of our earliest learners.

High-quality infrastructure helps kids learn, improves student outcomes, and reduces dropout rates.[6] The average age of Montana school facilities is 53 years, with well over $300 million in needed repairs. [7],[8] In 2017, the Montana Legislature restructured school infrastructure funding into two funding mechanisms: school major maintenance and debt service assistance. The school major maintenance fund provides for large, periodic investments, like new boilers or roof replacements, by subsidizing districts’ investments in these improvements on a prorated basis, depending on the taxable value per student (districts with lower property values who raise less money per mill receive more state assistance). The debt service assistance program helps districts fund new construction and major renovations. Montana should fully fund investments in school infrastructure to ensure that regardless of race, place, and income level, our children are walking into schools with resources to help children learn in the 21st century.

Too many children in Montana are slipping through the cracks without adequate support and services. The suicide rate is a national issue, having increased for 13 years in a row, but it is even more pronounced in Montana.[9] Montana has the second highest rate of suicide in the nation. Montana youth are dying of suicide almost three times as often as the national average.[10] As the long-term, intergenerational impact of colonization, cultural suppression, and oppression of Indigenous people has created a system where Indigenous youth experience higher rates of behavioral and mental health challenges and disproportionately high rates of suicide.[11] In 2017, 10 percent of all high school students in Montana reported suicide attempts within the last year, while nearly one-quarter of American Indian high school students on reservations reported suicide attempts (23 percent).[12] Montana can improve life outcomes for our children with ongoing investment in trauma-informed youth suicide prevention and education, with a focus on American Indian children.

In addition to the lack of critical investments in our children, tax policies that impose higher tax rates on families living on lower and middle incomes than the wealthy exacerbate the racial wealth gap. While in recent decades, people of color have made progress in many areas, state and local fiscal policies too often have not been part of this progress and instead have extended or cemented racial disparities in power and wealth.[13] For example, the structural changes to Montana’s tax system in 2003 that collapsed the number of income tax brackets from 10 to 6, lowered the top tax rate for personal income tax, and created a credit for capital gains increased the racial wealth gap, as white families in the nation are three times more likely to be in the top one percent of taxpayers than families of color.[14]

Luckily, there are many options that can help improve the fairness of Montana’s tax system while raising needed revenue for our children. Montana policymakers have a menu of options that will make Montana’s tax code fairer and raise needed revenue for essential services. These measures include:

These common sense solutions can raise almost $250 million, which can be used to improve outcomes for Montana’s children, ensuring a more robust economy for future generations.

Revenue in Indian Country

Kids do best when their communities have adequate revenue for education, public health and safety, and infrastructure. A long history of systemic racism and current day discriminatory practices have erected barriers that hold many American Indian children back from reaching their full potential. These barriers include the lack of jobs for their families, unaffordable or unavailable quality childcare, and a shortage of transportation options. In fact, 39 percent of American Indian children live in high poverty areas, compared to 7 percent of all Montana children.[15] High poverty areas are areas where 30 percent or more of the population are experiencing poverty (income of $21,720 or less annually for a family of three).

While tribal nations operate many of the same public services as other levels of government like maintaining roads, bridges, and other infrastructure; providing housing; and maintaining public order and safety, they often do so with fewer revenue sources and limited taxing authority. A history of legal battles and discriminatory legislation have diminished tribal nations’ exclusive authority to tax within their own reservation boundaries. Tribal self-sufficiency and self-government depend upon a tribe’s ability to raise revenue and regulate its territory.[16]

Exempting tribally owned fee land from property taxes, as it is done for federal, state, and local governments, would give tribal communities the same latitude as other governments in Montana to provide essential services and economic contributions to the state. Montana should also clear up taxation authority of tribal nations by enacting laws that defer to tribal nations for taxation on reservations, such as reservation sales and use taxes or tribal utility or severance taxes. These efforts will allow tribal governments to begin to adequately fund services and programs for their children and communities, like state and local governments throughout the state.

How Improving Tax Policies Will Help Families

Montana’s tax system requires those living on the least to pay a higher tax rate than the wealthy.[17] Montana can do better for these families and make it a little easier to support their children. Tax policies targeted to families, like the earned income tax credit (EITC), property tax circuit breakers, and the child tax credit can help Montana families afford necessities like clothing, school supplies, food, rent, and transportation.

Tax Credits for Working Families

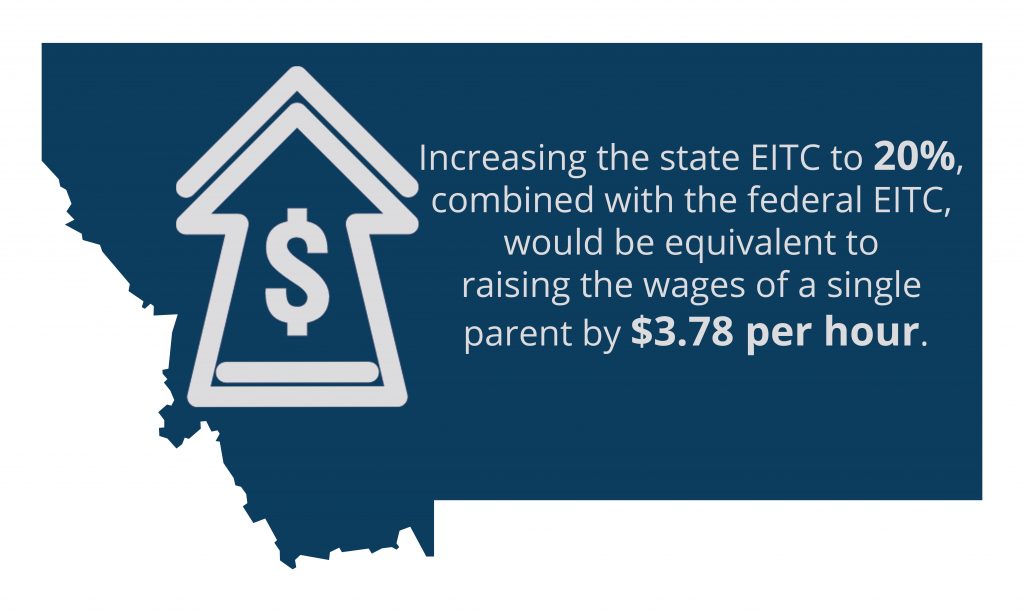

The federal EITC is the most effective anti-poverty program in history, lifting millions of families and children out of poverty. In 2017, the Montana Legislature passed a refundable state EITC on a healthy bipartisan vote. It is set at 3 percent of the federal EITC, effective for the 2019 tax year.[18] Approximately 74,000 working Montana families with low incomes benefit.[19] However, the state benefit is currently maxed out at $192, making it the weakest state EITC in the nation.[20]

Increasing the state EITC to 20 percent of the federal credit would further help Montana families provide for the needs of their kids. Coupled with the federal EITC, a 20 percent state EITC is equivalent to a wage increase of $3.78 an hour for a parent raising three children.[21] Supplementing the wages of working families allows parents to provide for their children and purchase needed goods locally.

Property Tax Help for Montanans on Low Incomes

While state policymakers continue to research and debate the level of property taxes in the state, any property tax reductions should be targeted to those who need it the most. Property taxes are regressive, meaning families living on lower incomes pay a larger share of their income in this tax than wealthy families. Property tax circuit breakers prevent property tax overload just like an electric circuit breaker: when the property tax bill exceeds a certain percentage of the taxpayer’s income, the circuit breaker reduces the property taxes in excess of the circuit breaker.[22]

With residential property taxes making up more and more of the total share of property taxes over time, homeowners and renters are feeling the pinch of high property taxes. Due in part to legislative decisions to exempt business property from the tax base and a lack of state investment leaving communities to pick up the slack, in the last two decades, the share of property taxes falling on the backs of individual homeowners has risen – from 34 percent in 1994 to more than 48 percent today.[23] A property tax circuit breaker would target property tax relief to families who need it most.

Tax Credit to Help Parents Make Ends Meet

The federal child tax credit (CTC) is designed to provide an income boost to parents or guardians of children and other dependents, helping working families offset the cost of raising children. This tax credit is a powerful weapon against poverty, lifting 4.3 million people nationwide out of poverty in 2018, including about 2.3 million children.[24] In fact, one of the best ways to help families afford the heavy cost of child care is to invest in a state child tax credit.

Currently the federal CTC is nonrefundable meaning the lowest income families cannot reap the full benefits of the credit. Montana can help the families struggling the most and lift children out of poverty by adopting a fully refundable state child tax credit. For families currently not receiving the full $2,000 per child federal tax credit, they would receive a state-level refundable credit bringing their combined state and federal credits to the full $2,000 per child.[25] This incredibly progressive tax credit would target the greatest benefit to the families with the lowest incomes (those earning up to $36,400 annually), with the credit tapering off as income increases. With this credit, Montana would see a reduction in child deep poverty of greater than 15 percent.[26]

A Montana Children Can Count On

Montana has a chance to improve the lives and futures for our children. By better balancing our revenue system, we can invest for the long term and ensure opportunity for the next generation. Investing in our families through education, healthy food, and safe communities can help our children live the lives we hope for them.

Montana can learn from other states who have used thoughtful state revenue policies to improve the lives of children. A few years ago, Minnesota was struggling. The state was not raising enough money to fund schools or keep a competitive economy, and the tax system was becoming increasingly unfair.[27] In 2013, Minnesota raised the income tax rate by two percentage points (to 9.85 percent) for those making over $250,000.[28] The revenue allowed the state to invest in schools, health care, affordable college education, job creation, and more.[29] Minnesota moved from a state ranking for childhood well-being of 6th in 2012 to 3rd in 2013, and 1st in 2015.[30]

Montana can do better for our children by following the lead of states like Minnesota who have chosen to progressively raise revenue and put it into programs that are proven to improve the lives of children and families. Allowing tribal nations to raise revenue to provide for local needs like infrastructure, schools, and public health and safety puts children in all communities on more even ground across the state.

This is the time to take bold action to improve child well-being in Montana. Cleaning up Montana’s tax code is how we will pay for the building blocks of opportunity for every child in Montana, building a brighter future for all of us.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.